AITA, My S/O asked me to co-sign a loan and I said yes but… Now she is saying I’m unsupportive and unfair.

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

Financial Trust or Control? A Couple’s Dilemma

In a tense standoff over a significant loan, a partner grapples with the balance between support and financial security. After years of separate finances, the request to co-sign a hefty HELOC sparks a debate about transparency and trust. As conditions are laid out, what seems like a reasonable request for accountability turns into a clash of values, leaving both partners questioning their roles in the relationship. This story resonates with anyone who’s navigated the complexities of love and money, especially in a culture where financial independence is often prioritized.

Family Drama Over Loan Co-Signing: A Conflict Resolution Dilemma

In a recent situation, a significant other (SO) found themselves in a heated argument regarding a loan co-signing request. The conflict has raised questions about fairness and support within their long-term relationship. Here’s a breakdown of the events:

- Background: The couple has been together for about 10 years and shares a child. They maintain separate finances, with each partner responsible for their own bills, although they share some expenses.

- Loan Request: The SO’s partner requested a co-signature for a Home Equity Line of Credit (HELOC) ranging from $100,000 to $150,000 to consolidate her debts. The SO had previously received support from their partner in consolidating their own debts of $15,000 to $20,000.

- Conditions Set: While the SO agreed to co-sign, they proposed several conditions:

- Documenting the agreement and the amount to be borrowed.

- Providing a detailed account of the partner’s income and debts.

- Including a clause that no funds could be withdrawn without mutual consent.

- Partner’s Reaction: The partner found the request for detailed financial disclosure demeaning but ultimately complied. However, she was resistant to the clause regarding fund withdrawal, viewing it as unfair since the property was hers and she would be responsible for repayment.

- Future Plans: The partner mentioned a plan to sell an investment property within five years to pay off the loan, but this was not made a condition by the SO. The SO wanted to include this in the written agreement for clarity.

- Disagreement Escalates: The SO felt that including the withdrawal clause was a reasonable safeguard, while the partner viewed it as a lack of support. This disagreement led to heightened tensions between them.

As the situation unfolded, the SO began to question their role in the conflict and whether their requests were justified or overly controlling. They sought external perspectives to determine if they were in the wrong for wanting to protect their financial interests while supporting their partner.

This scenario highlights the complexities of family drama and the challenges of conflict resolution in relationships, especially when finances are involved. The couple must navigate their differing views on financial transparency and support to find a resolution that works for both parties.

This is Original story from Reddit

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

Story

So I got into a pretty heated argument with my SO and am seriously questioning if I am the AH? About two weeks ago, my significant other asked me to co-sign for a pretty significant loan, between 100-150k HELOC against her house so that she could consolidate her debts. She has helped me consolidate my debts, 15-20k, by co-signing in the past, so, of course, I said yes.

Some general background info: We’ve been together for about 10 years and have a pretty good relationship despite some financial disagreements. Due to that, we have not combined our finances, and she pays her bills while I pay mine. We do share some expenses, as we have a child together and we live in my house.

This is where things get difficult. While I agreed to co-sign, I had some conditions. I requested that we write down what we were agreeing to and how much we’d be borrowing.

I asked her to spell out her income to debt, as I have an idea but don’t really know her finances. She said it was demeaning to her to make her list them out; however, she did it. Then we talked about some what-if scenarios, and ultimately, she said that her plan was to sell an investment property within the next five years to pay off the loan.

I didn’t make that a condition; she offered it, so I wanted to write that in the agreement. Additionally, she agreed to make me a beneficiary on a life insurance policy should anything happen to her. After looking at everything, I felt she would be able to comfortably pay the note and her regular bills.

Ultimately, it would be about 105-110k in debts. However, she wanted to ask for 150k so that she wasn’t maxing out the line of credit. So as I wrote up the agreement, I included the sentence, “No money can be withdrawn without both parties’ approval.” That was just too much for her, and she said it was a non-starter and completely unfair.

It was her house, and she would be paying back the loan. I offered to write down all the debts we’d discussed to be included so the 110k would be included automatically. She said she would never ask that of me and I wasn’t supporting her by including that.

So here I am asking for internet strangers to shed some perspective… am I the AH?

View the Original Reddit Post Here

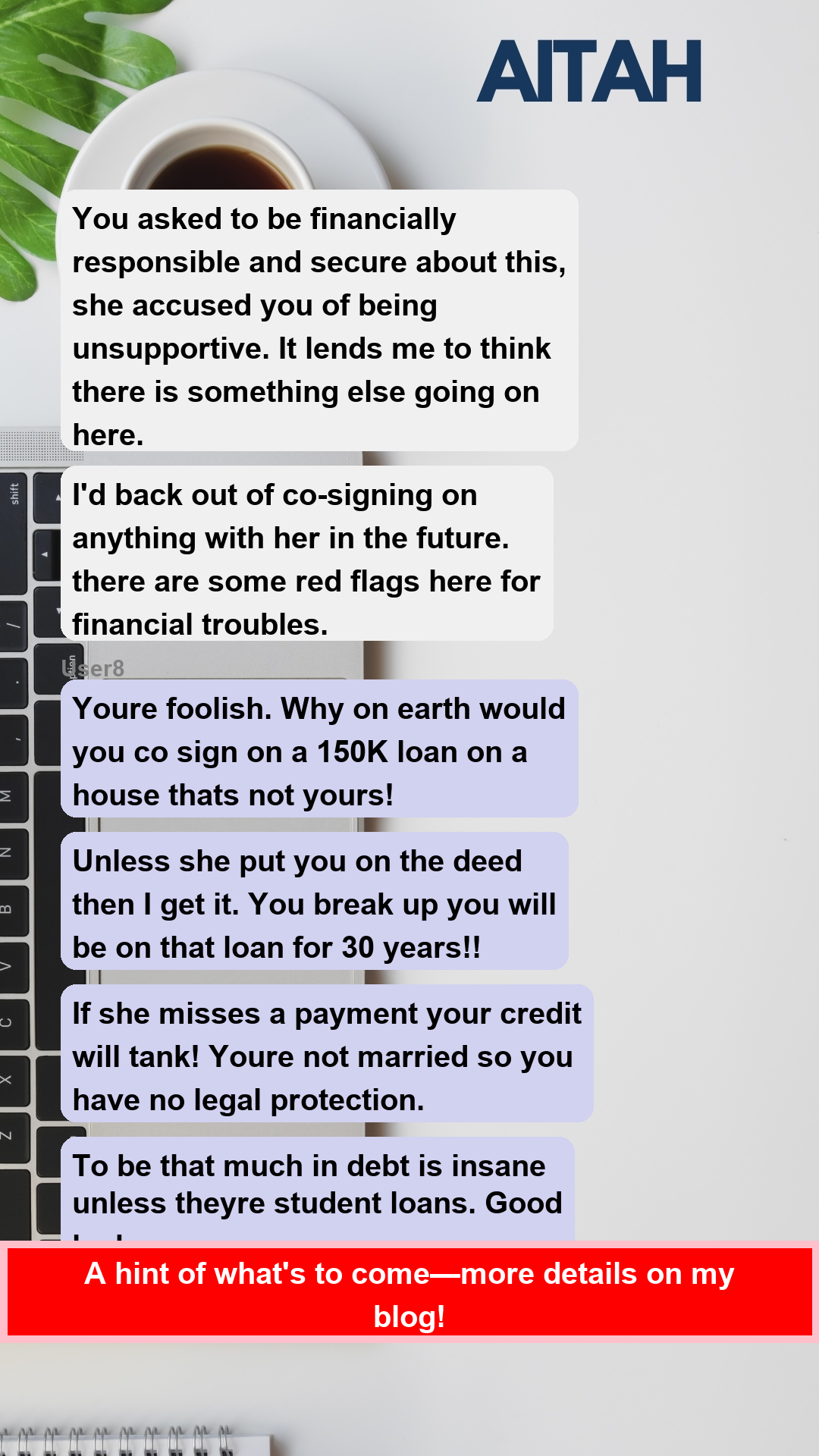

Summary of Reddit Comments

The top Reddit comments indicate a strong consensus against co-signing the loan due to the significant amount of debt the significant other already carries and the potential financial risks involved. Many users express concern about her financial management skills and suggest that agreeing to co-sign could lead to serious repercussions for the commenter, especially given the lack of legal protection in their relationship. Overall, the comments highlight the importance of financial responsibility and caution in relationships involving significant debt.

Verdict: NTA

Expert Advice for Resolving the Conflict

In navigating the complexities of financial decisions within a long-term relationship, it’s essential to approach the situation with empathy and a focus on mutual understanding. Here are practical steps for both partners to consider in resolving their conflict over the loan co-signing request:

For the Significant Other (SO)

- Reflect on Concerns: Take time to understand your partner’s perspective. Acknowledge her feelings about the financial disclosure and the withdrawal clause. This can help in fostering a more open dialogue.

- Communicate Clearly: Express your reasons for wanting the conditions in a calm and respectful manner. Emphasize that your intentions are to protect both of your financial interests, not to undermine her autonomy.

- Consider Compromise: Be open to negotiating the terms of the agreement. Perhaps you can agree on a modified version of the withdrawal clause that still provides you with some level of security without feeling overly controlling.

- Seek Professional Guidance: Suggest consulting a financial advisor or a mediator who can provide an objective perspective on the situation. This can help both of you understand the implications of co-signing and the importance of financial transparency.

For the Partner

- Understand the SO’s Position: Recognize that your partner’s request for financial documentation and a withdrawal clause stems from a place of concern for both of your financial futures. Try to see it as a protective measure rather than a lack of support.

- Be Open to Discussion: Engage in a constructive conversation about your financial situation. Sharing your plans for the investment property and how you intend to manage the loan can help alleviate some of your partner’s concerns.

- Evaluate Financial Management: Reflect on your current financial practices and consider whether improvements can be made. This can build trust and demonstrate your commitment to responsible financial management.

- Explore Alternative Solutions: If co-signing feels too risky, discuss other options for consolidating your debts that do not involve your partner’s financial backing. This can help maintain the integrity of your relationship while addressing your financial needs.

Joint Steps Forward

- Set a Time for Discussion: Schedule a dedicated time to discuss the loan request and related concerns without distractions. This shows commitment to resolving the issue together.

- Establish Common Goals: Identify shared financial goals as a couple. This can help both partners align their interests and work collaboratively towards a solution.

- Document Agreements: If you reach a consensus, ensure that any agreements are documented clearly. This can prevent misunderstandings and provide a reference point for both parties.

- Prioritize Relationship Health: Remember that financial discussions can be stressful. Make sure to check in with each other emotionally and prioritize the health of your relationship throughout this process.

By approaching the situation with empathy, open communication, and a willingness to compromise, both partners can work towards a resolution that respects their individual needs while strengthening their relationship.

Join the Discussion

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

What do you think? Would you have handled this differently?

Share your thoughts below! Vote: Do you agree with Reddit’s verdict?