AITA for not getting over my sister “borrowing” money?

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

When Family Ties Turn into Financial Strain

At just 17, a young woman faces a heartbreaking betrayal when her older sister, the custodian of her inherited funds, siphons off thousands of dollars meant for her college education. With a family history of financial struggles and differing perspectives on money, tensions rise as she grapples with the consequences of her sister’s actions. As her grandparents urge forgiveness for the sake of family harmony, she must decide whether to prioritize her future or maintain peace. This relatable dilemma highlights the complexities of trust, responsibility, and the impact of financial hardship within families.

Family Drama Over Inherited Money: A Conflict Resolution Dilemma

A 17-year-old female (referred to as OP) is facing a significant family conflict regarding the management of her inherited funds. The situation has escalated into a family drama that raises questions about trust, financial responsibility, and the impact of personal circumstances on familial relationships.

- Background:

- OP inherited $6,000 from her great-grandfather, which is held in a custodial account.

- Due to her age, OP cannot access the funds without her custodian’s permission.

- Her sister (26f) became the custodian, while OP’s grandparents are her guardians after the death of her parents when she was 7.

- Sister’s Financial Situation:

- OP’s sister also inherited $6,000 but spent it quickly.

- She is currently unemployed and has two young children.

- Withdrawal Issues:

- OP initially withdrew $1,000, leaving $5,000 in the account.

- Concerns about her sister’s financial management led OP and her grandparents to decide to transfer the funds to an account under OP’s name.

- After multiple requests, OP’s sister provided only $1,000, claiming the bank had restrictions on withdrawals.

- Discovery of Missing Funds:

- OP received a bank statement revealing that her sister had withdrawn $870 without her knowledge.

- After contacting her sister, OP was met with denial and accusations against the bank.

- Ultimately, her sister withdrew a total of $3,135, leaving OP with only $1,800.

- Family Reactions:

- OP’s sister acknowledged her wrongdoing but suggested she would repay the money through a loan or tax returns.

- OP’s other sister (24f) believes OP is being too harsh, citing OP’s lack of experience with financial struggles.

- OP’s grandparents are upset but wish to avoid further conflict due to health concerns.

- OP’s Perspective:

- OP is frustrated and feels her sister’s actions jeopardize her college plans, as she intended to use the funds for expenses not covered by her scholarship and Pell Grant.

- Despite her sister’s assurances, OP is hesitant to let the matter go, feeling it is a significant breach of trust.

In conclusion, OP is grappling with the emotional and financial implications of her sister’s actions. The family drama surrounding this situation highlights the complexities of conflict resolution within families, especially when financial matters are involved. OP is left questioning whether she is justified in her feelings or if she should be more understanding of her sister’s circumstances.

This is Original story from Reddit

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

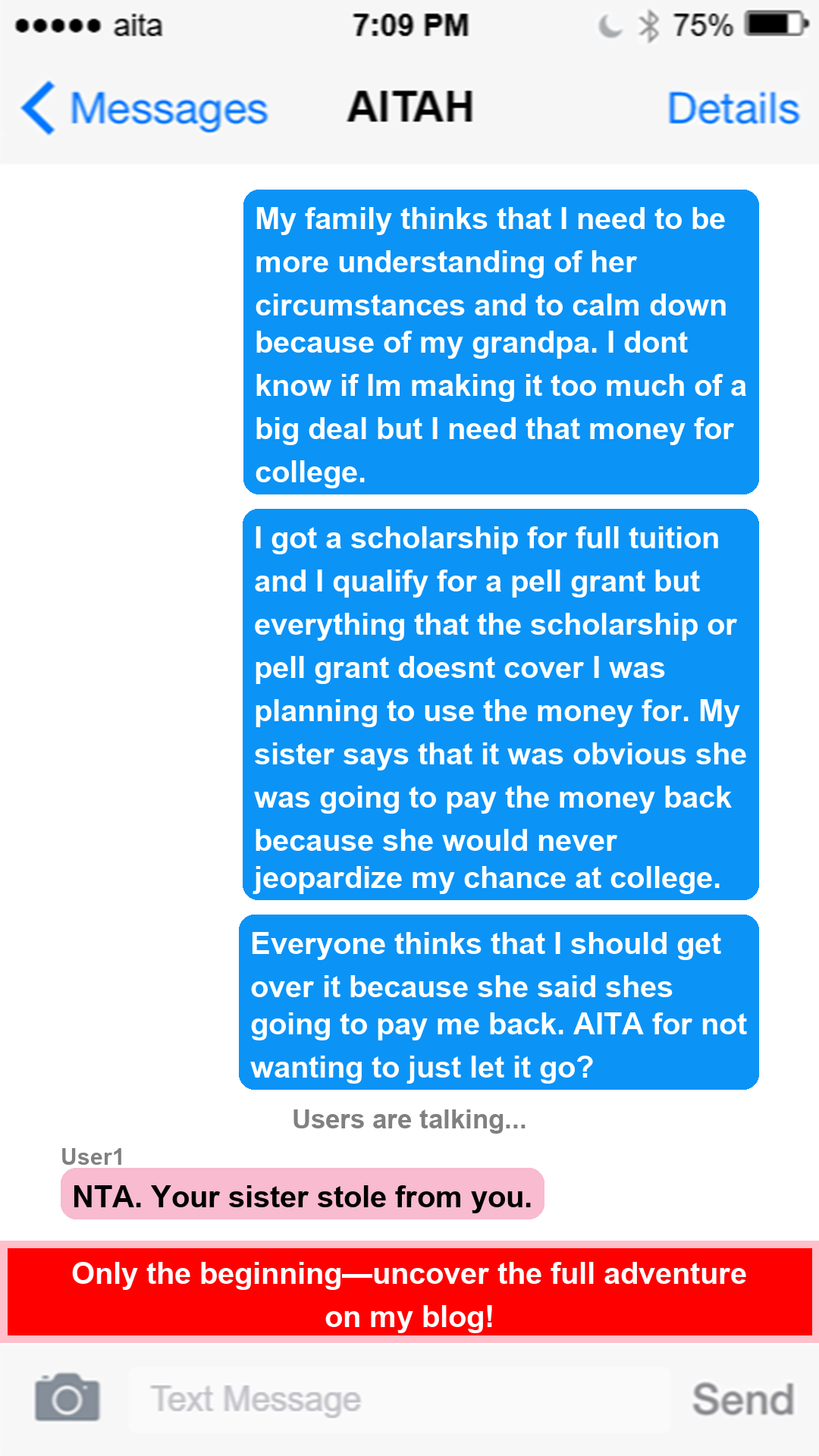

Story

I, 17f, inherited $6,000 from my great-grandfather a few months ago. Since I am under the age of 18, the account was a custodial account, which means I have to have someone to take care of it. This means that I cannot take money out of the account without the permission of my custodian, but the custodian can take out as much as they want.

My parents died when I was 7, and my grandparents became my guardians. They are my father’s parents, while my great-grandfather was on my mother’s side, so they were not in the will. The lawyer that set everything up said it would be easier if someone in the will was the custodian, so my sister, 26f, became my custodian.

My sister also inherited $6,000 that she quickly spent. She has two kids, 6f and 5m, and she and her husband are both unemployed. When I set up my account, I got $1,000 out, so there was supposed to be $5,000 left in the account.

My sister has a record of not being good with money, so my grandparents and I agreed it would be better to get the money out of the account and put it in one under my name. After weeks of asking my sister to get my money out, last week she gave me $1,000 of it and said that the bank wouldn’t allow her to get any more out at one time. Yesterday, I got a letter from the bank telling me my bank balance.

She had gotten $870 out of my account without telling me. She would not pick up my calls, so I had to call her husband to talk to her. She started yelling about how the bank must have messed up and took the money out of my account instead of hers.

She said that she would get the rest out of the bank and bring it to me and that she would pay me back. She got the rest of the money out today, and there’s only $1,800. There was supposed to be $3,135.

She lied about the $870 and then got another $1,335 out for herself. She owes me $2,185. She said that she is going to try to get a loan, and if she can’t, she’ll pay me back using her tax returns.

She wrote a letter about how she knew she was in the wrong and that she had meant to get the money back in the account before I noticed. I am mad at her, but our other sister, 24f, thinks that I am being too hard on her because I’ve never known what it was like to struggle for money like that. My grandparents are mad, but my grandpa has a weak heart and wants to put this all behind us because the stress is bad for his health.

My family thinks that I need to be more understanding of her circumstances and to calm down because of my grandpa. I don’t know if I’m making it too much of a big deal, but I need that money for college. I got a scholarship for full tuition, and I qualify for a Pell Grant, but everything that the scholarship or Pell Grant doesn’t cover, I was planning to use the money for.

My sister says that it was obvious she was going to pay the money back because she would never jeopardize my chance at college. Everyone thinks that I should get over it because she said she’s going to pay me back. AITA for not wanting to just let it go?

View the Original Reddit Post Here

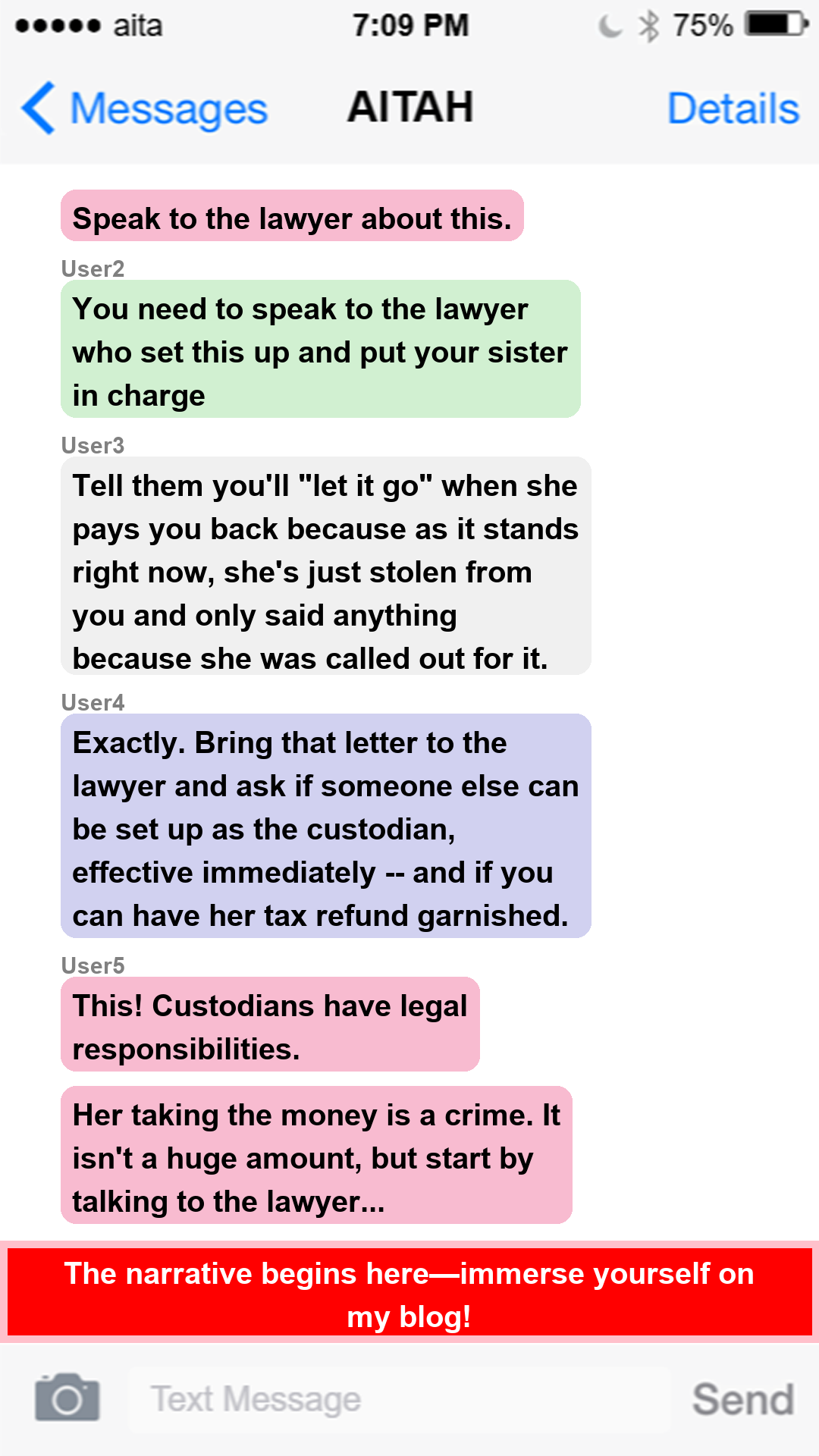

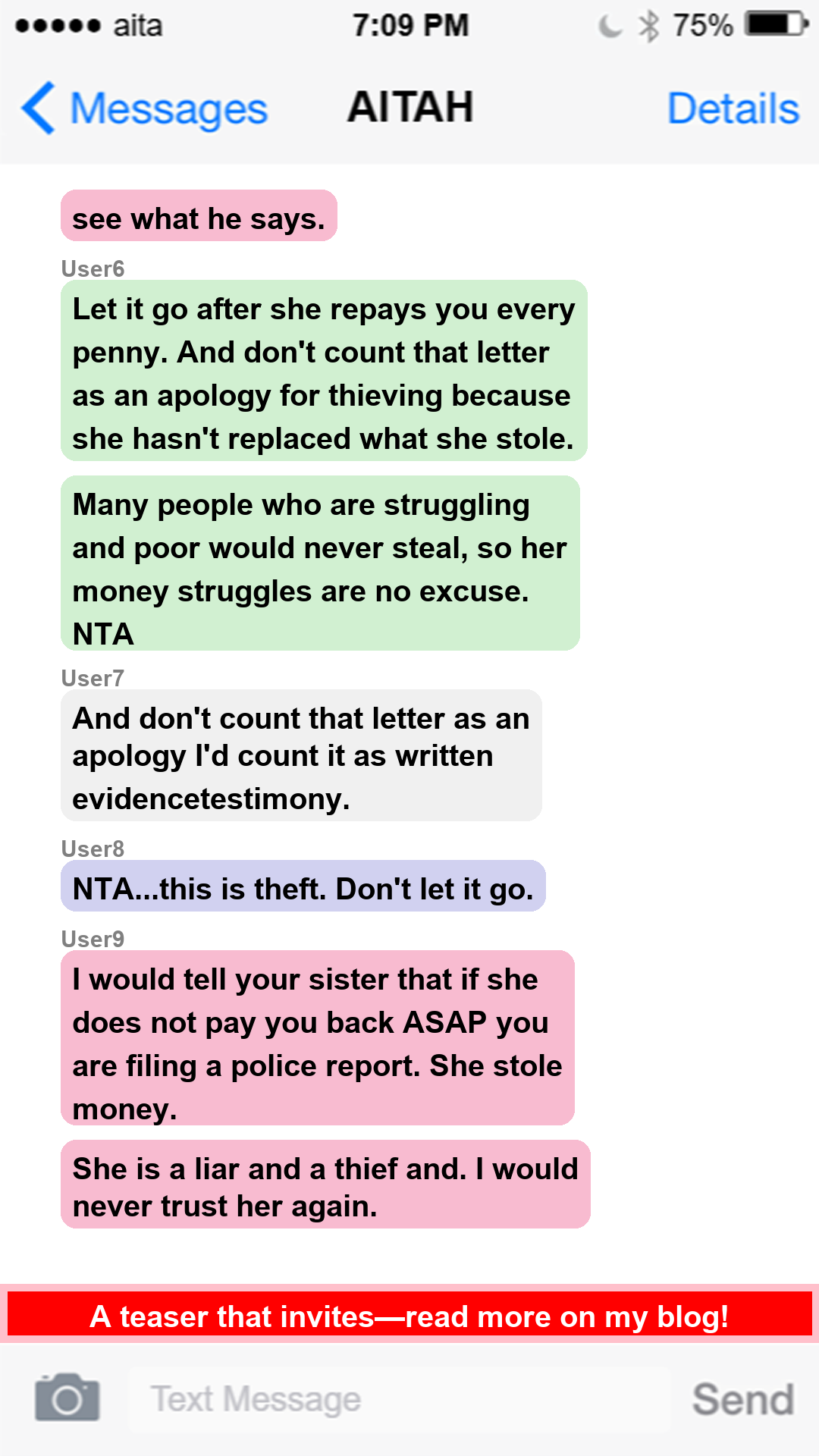

Summary of Reddit Comments

The top Reddit comments reveal a strong consensus around NTA due to the clear act of theft committed by the sister and the legal implications involved. Most users agree that the sister should repay the stolen money and that the original poster should consult a lawyer to address the situation, emphasizing that financial struggles do not justify her actions.

Overall Verdict

NTA

Expert Advice for Resolving the Conflict

Family conflicts, especially those involving finances, can be incredibly challenging and emotionally charged. Here are some practical steps for both OP and her sister to consider in resolving this situation while maintaining family relationships.

For OP: Steps to Address the Situation

- Document Everything: Keep a detailed record of all transactions, communications, and agreements regarding the inherited funds. This documentation will be crucial if legal action becomes necessary.

- Communicate Openly: Arrange a calm and private conversation with your sister. Express your feelings about the situation without accusations. Use “I” statements, such as “I feel hurt and betrayed by what happened,” to foster understanding.

- Set Clear Boundaries: Make it clear what you expect moving forward. If you are willing to consider a repayment plan, outline the terms and timeline that would work for you.

- Consult a Lawyer: Given the financial implications and potential legal issues, it may be wise to seek legal advice. A lawyer can help you understand your rights and options regarding the custodial account and any potential recovery of funds.

- Involve a Mediator: If direct communication proves difficult, consider involving a neutral third party, such as a family mediator, to facilitate the conversation and help both sides reach an agreement.

For the Sister: Steps to Take Responsibility

- Acknowledge the Mistake: Accept responsibility for your actions. A sincere acknowledgment can go a long way in rebuilding trust with your sister.

- Communicate Your Situation: Share your financial struggles openly with OP. While this doesn’t excuse your actions, it may help her understand your perspective and the pressures you are facing.

- Propose a Repayment Plan: Offer a realistic plan to repay the funds you withdrew. Be specific about how and when you can make these payments, whether through your income, tax returns, or other means.

- Seek Financial Counseling: Consider seeking help from a financial advisor or counselor to better manage your finances and avoid similar situations in the future.

- Rebuild Trust: Work on rebuilding trust with OP by being transparent about your financial situation and keeping her informed about any repayments or financial decisions that may affect her.

Conclusion

Resolving this conflict will require patience, understanding, and a willingness to communicate openly. Both OP and her sister have valid feelings and concerns, and addressing them constructively can lead to a healthier family dynamic moving forward. Remember, it’s essential to prioritize relationships while also standing firm on principles of trust and responsibility.

Join the Discussion

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

What do you think? Would you have handled this differently?

Share your thoughts below! Vote: Do you agree with Reddit’s verdict?