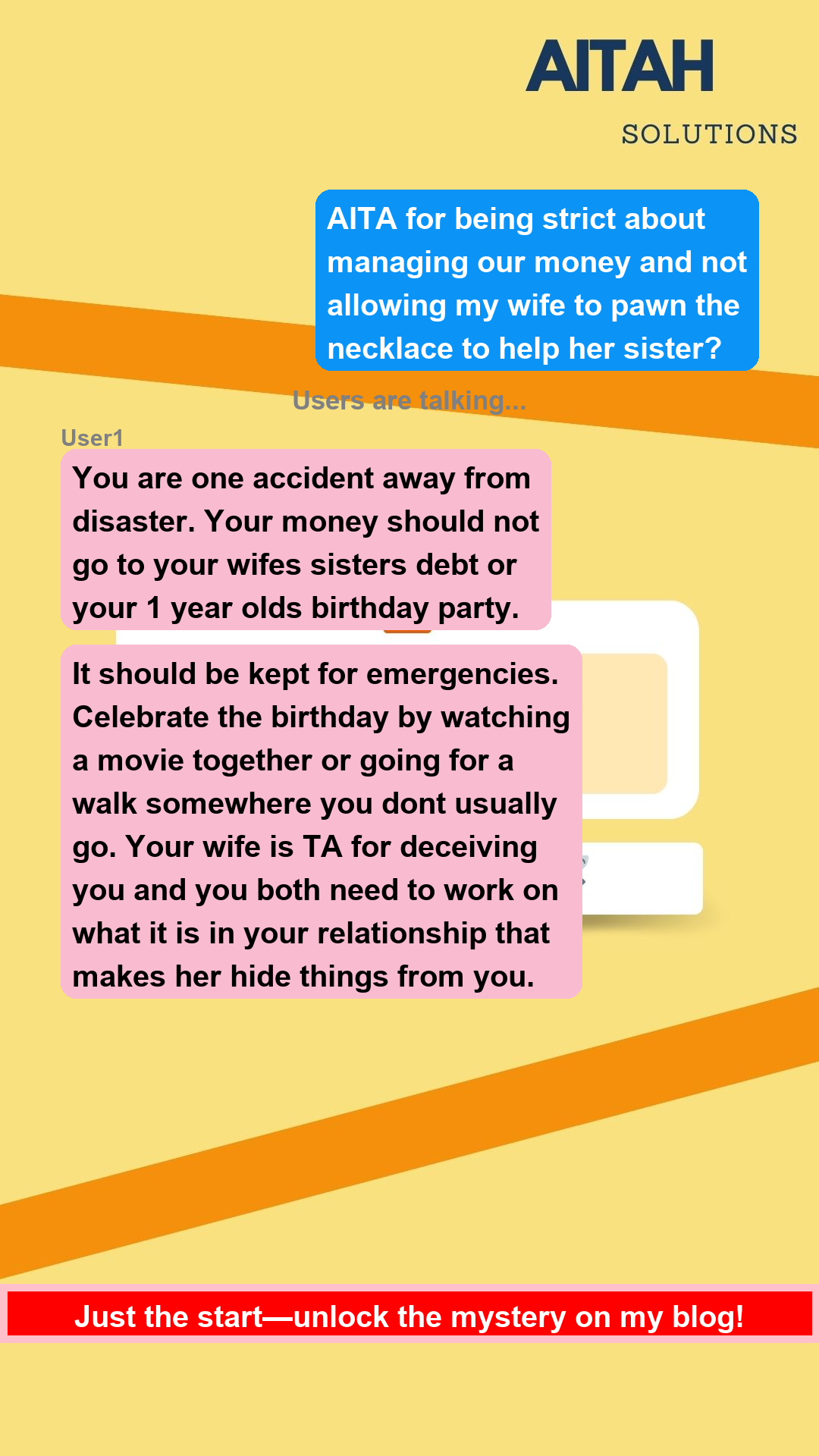

AITA for being strict about managing our money and not allowing my wife to pawn her necklace to help her sister pay off debt?

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

Financial Struggles and Family Tensions: A Husband’s Dilemma

In a heartfelt tale of financial strain, a husband grapples with the challenges of managing his family’s tight budget while trying to maintain harmony at home. With a monthly income of just $850, he faces mounting pressure as his wife’s spending habits clash with his desire for stability, leading to a heated argument over a cherished family heirloom. This relatable story highlights the complexities of partnership, trust, and the sacrifices families make for one another, resonating deeply with anyone who has navigated financial hardships in their own lives.

Family Financial Struggles and Wedding Tension

A 28-year-old man from the Philippines is facing significant family drama as he navigates financial difficulties while trying to manage his household budget. Here’s a summary of the situation:

- Current Financial Situation:

- He is the sole breadwinner, earning approximately $850 a month.

- After covering bills and groceries, there is little left for savings or discretionary spending.

- He has two children: a 7-year-old son and a daughter who will turn 1 soon.

- Budgeting Challenges:

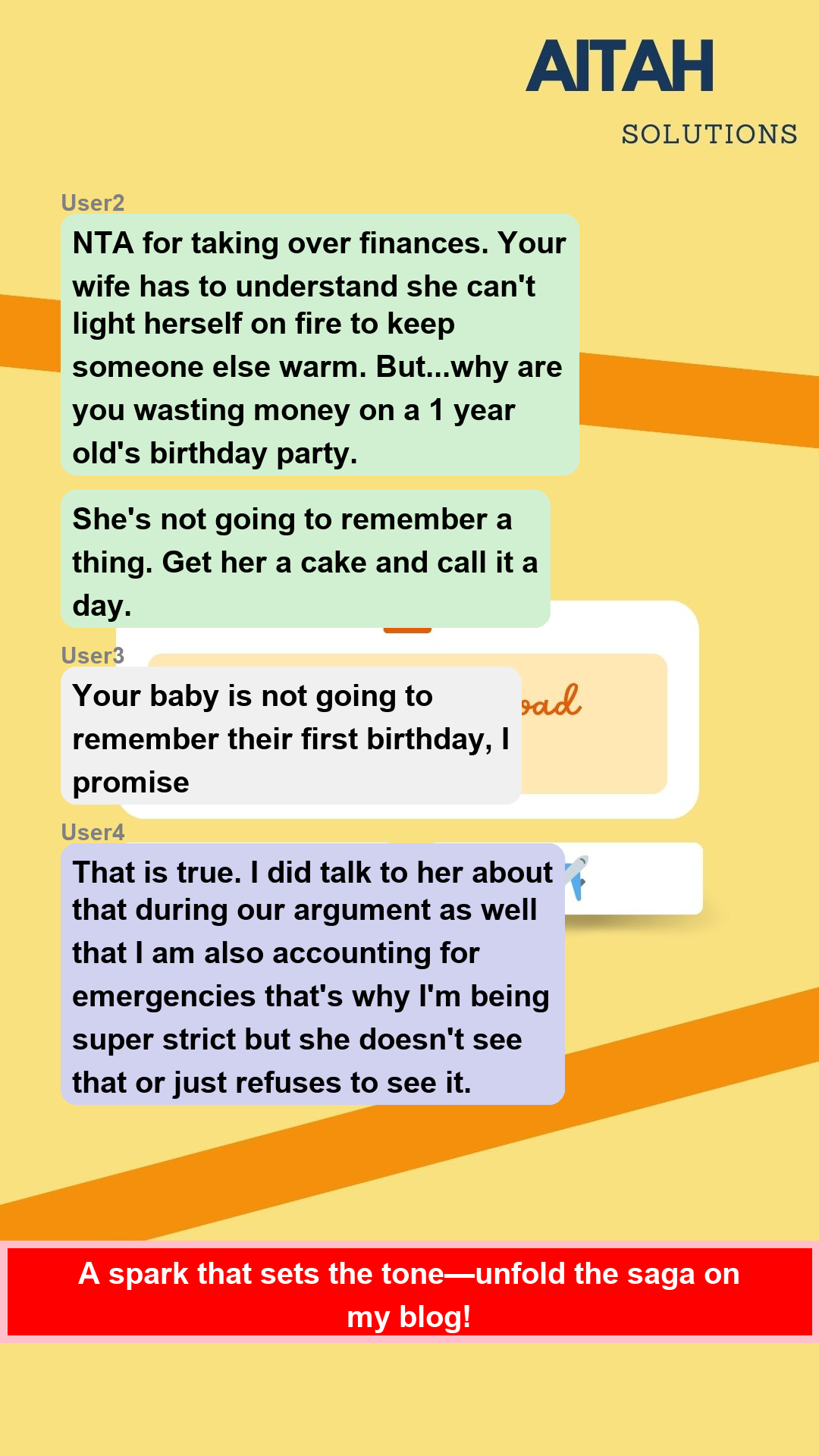

- In January, he received $828 and allocated $234 for bills and $144 for household expenses.

- Due to poor budgeting, the family quickly depleted their funds, leaving only $54 in savings by the next paycheck.

- He had to use savings intended for his daughter’s birthday to cover essential expenses.

- Conflict Resolution Attempts:

- To regain control, he decided to manage the finances for the next two paychecks.

- He communicated to his wife that she could still access money but needed to inform him of the amounts and purposes.

- His wife reacted negatively, feeling that he did not trust her and accused him of being selfish.

- Additional Tensions:

- He discovered his wife planned to pawn her necklace to help her sister pay off debt.

- He expressed his concerns, emphasizing the importance of financial stability for their family.

- This led to a heated argument, with his wife stating she would rather not celebrate their daughter’s birthday than refuse to help her sister.

- Ongoing Issues:

- His wife has been resistant to discussing their shared finances and has been acting immaturely regarding their budget.

- He feels hurt and frustrated, believing he has been clear about their financial plans and the need for stability.

- He questions whether he is in the wrong for being strict about managing their money and opposing the pawn of the necklace.

This situation highlights the complexities of family dynamics, financial management, and the challenges of conflict resolution within a marriage. The couple is at a crossroads, needing to find a way to communicate effectively and prioritize their family’s needs while addressing external pressures.

This is Original story from Reddit

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

Story

I, a 28M, am from the Philippines and have been in a bit of a financial bind recently, trying to manage our family’s finances as best I can. My wife, 28F, and I have two kids: a 7-year-old son and a daughter who will be turning 1 soon. I’m the only one working, and I earn about 850 a month. After paying bills and groceries, money is tight.

In January, I received a total of 828. I paid 234 in bills in total and gave my wife 144 to budget for the first two weeks. The rest, I kept as savings for our daughter’s birthday, with the plan to add more in the upcoming paychecks.

Unfortunately, we didn’t manage the 144 well, and by the next paycheck, we were down to 54 in savings. On January 10th, I noticed my wife only had 28 left, and by the 12th, she was down to just 5. When I asked how that happened, she got upset but said not to worry because it was all spent on us.

At this point, I had to dip into the savings I set aside for our daughter’s birthday to cover expenses. Fast forward to later in the month, and I decided to take control of the finances for the next paycheck. I told my wife I would be handling the money for the next two paychecks so I could keep track of everything.

I told her she could still take money from my wallet, but she would have to let me know how much and what it was for. She got upset, saying I don’t trust her and that I was being selfish. A few days later, I discovered she was planning to pawn her necklace to help her sister pay off her debt.

I tried to open up a conversation by asking about her sister’s situation, hoping she would tell me about the necklace. Eventually, I directly asked if she planned to pawn it to help her sister, and she admitted it. I told her I was against it because we were already in a tough spot financially, and we needed the necklace for our daughter’s birthday.

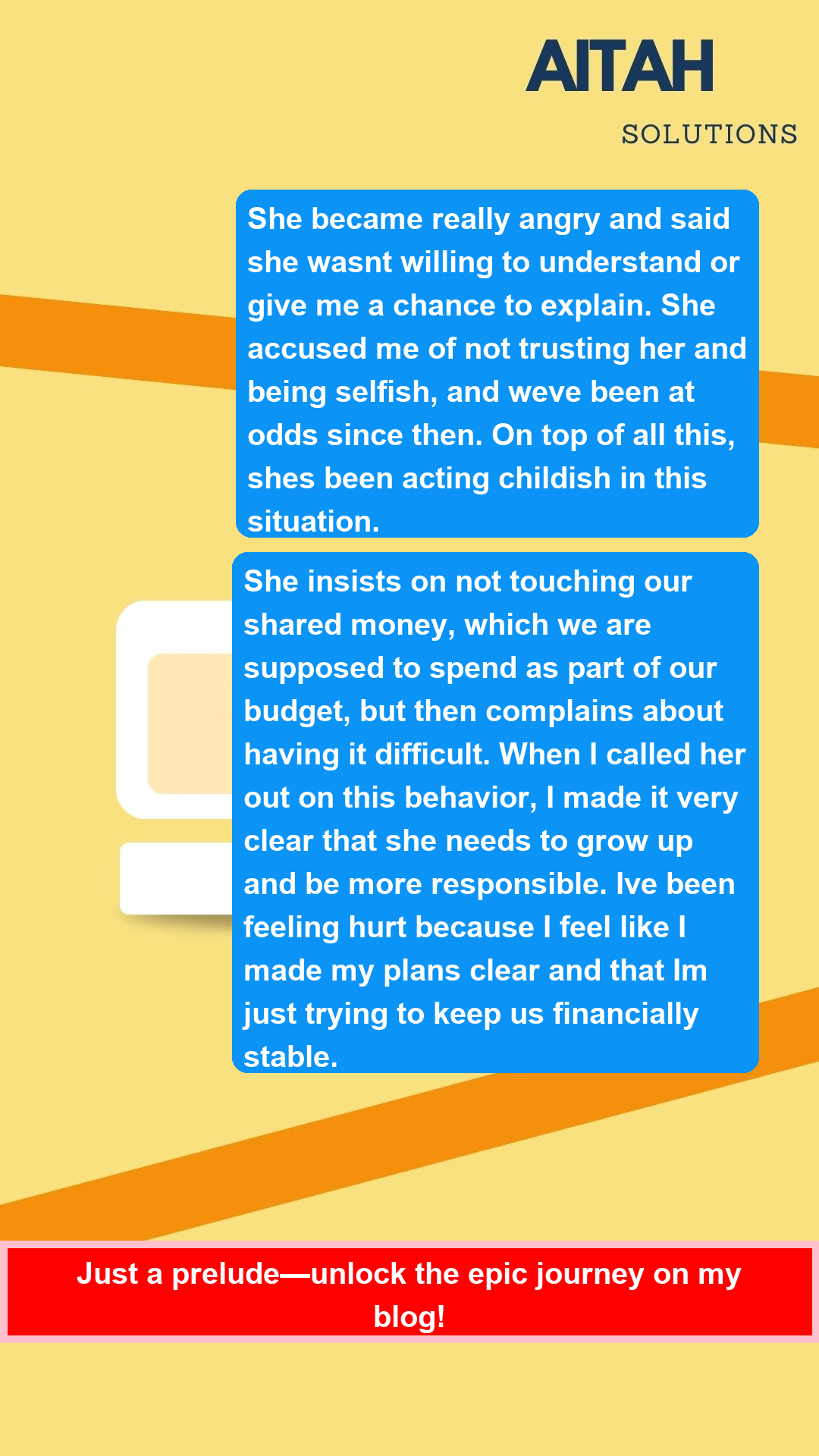

That led to an argument, and she said she’d rather not celebrate our daughter’s birthday than not help her sister. I tried to explain that it’s okay to help others, but it can’t come at the cost of our own financial stability. She became really angry and said she wasn’t willing to understand or give me a chance to explain.

She accused me of not trusting her and being selfish, and we’ve been at odds since then. On top of all this, she’s been acting childish in this situation. She insists on not touching our shared money, which we are supposed to spend as part of our budget, but then complains about having it difficult.

When I called her out on this behavior, I made it very clear that she needs to grow up and be more responsible. I’ve been feeling hurt because I feel like I made my plans clear and that I’m just trying to keep us financially stable. AITA for being strict about managing our money and not allowing my wife to pawn the necklace to help her sister?

View the Original Reddit Post Here

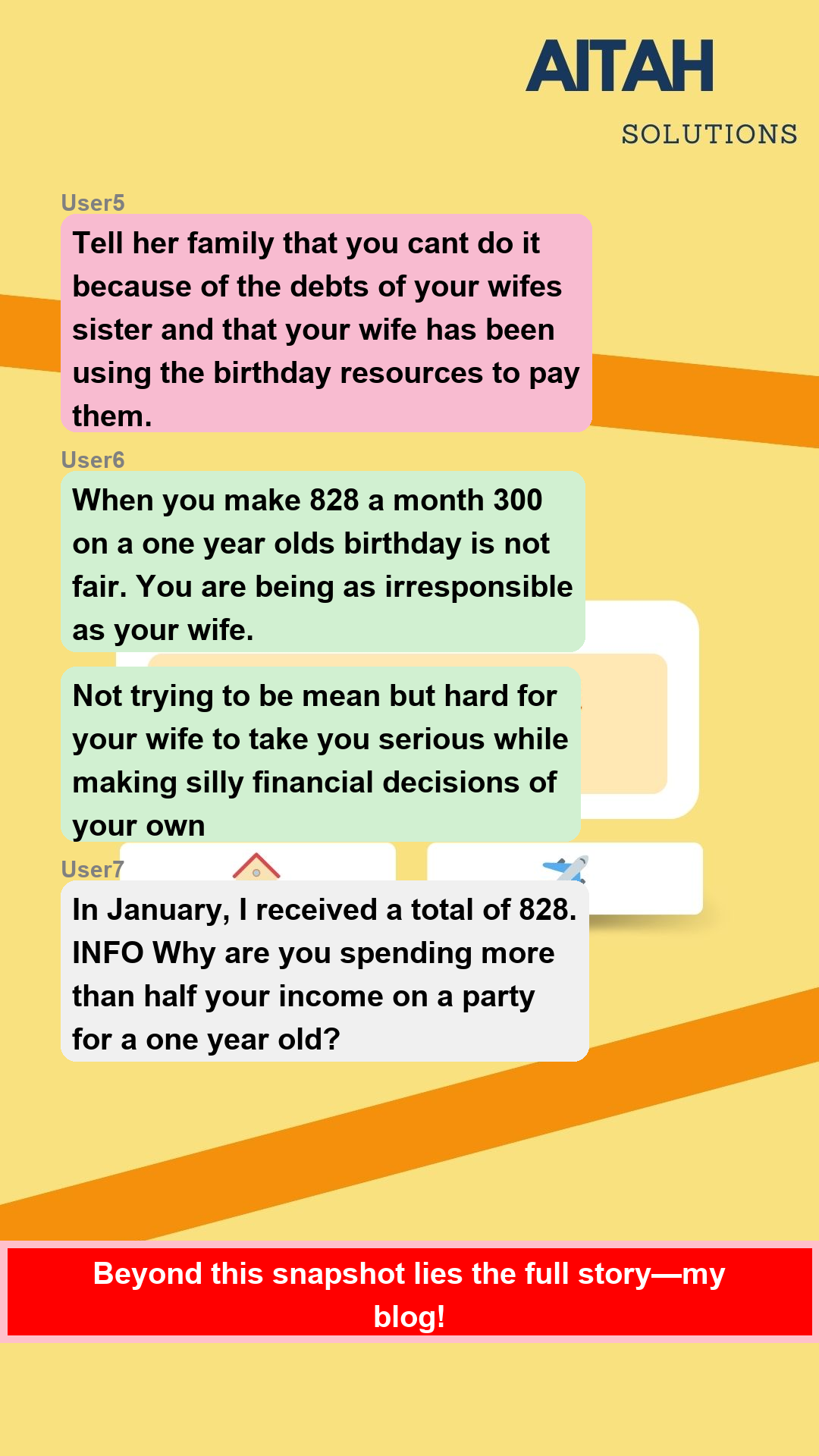

Summary of Reddit Comments

The top Reddit comments indicate a strong consensus that the husband is not the asshole (NTA) for prioritizing financial stability over a lavish birthday celebration for their one-year-old. Many users emphasize the importance of saving for emergencies and criticize the wife’s decision to allocate funds towards her sister’s debt instead of their child’s birthday. The comments reflect a broader concern about financial responsibility and the need for open communication in the relationship.

Overall Verdict: NTA

Expert Advice for Resolving the Conflict

In navigating the complexities of financial struggles and marital tensions, it’s essential for both partners to engage in open communication and collaborative problem-solving. Here are some practical steps to help resolve the conflict:

For the Husband

- Initiate a Calm Discussion: Set aside time to talk with your wife when both of you are calm. Express your feelings about the financial situation without placing blame. Use “I” statements, such as “I feel stressed about our finances” to convey your perspective.

- Share Financial Goals: Clearly outline your financial goals as a family. Discuss the importance of saving for emergencies and how this can benefit everyone in the long run. Make it a joint effort to create a budget that reflects both your needs.

- Involve Your Wife in Budgeting: Instead of solely managing the finances, invite your wife to participate in the budgeting process. This can help her feel more included and responsible for financial decisions, fostering a sense of teamwork.

- Address Emotional Needs: Acknowledge your wife’s desire to help her sister and validate her feelings. Discuss how you can support family members without jeopardizing your own family’s financial stability.

For the Wife

- Listen Actively: Take the time to understand your husband’s concerns about finances. Listen to his perspective without interrupting, and try to see the situation from his point of view.

- Communicate Your Feelings: Share your feelings about wanting to help your sister and why it’s important to you. Explain your perspective on family obligations and how they impact your decisions.

- Collaborate on Solutions: Work together to find a balance between helping your sister and maintaining your family’s financial health. Consider setting aside a small amount for family support while prioritizing your immediate needs.

- Be Open to Compromise: Understand that financial decisions often require compromise. Be willing to discuss alternatives that allow you to support your sister without sacrificing your family’s stability.

Joint Steps to Consider

- Set a Family Meeting: Schedule regular family meetings to discuss finances, goals, and any concerns. This can help create a safe space for both partners to express their thoughts and feelings.

- Create a Joint Budget: Develop a budget together that includes essential expenses, savings, and discretionary spending. Make sure both partners agree on the allocations to foster a sense of ownership.

- Seek Professional Guidance: If financial discussions continue to be challenging, consider seeking help from a financial advisor or a marriage counselor. They can provide neutral guidance and strategies for effective communication.

- Celebrate Small Wins: Acknowledge and celebrate small financial achievements together. This can help build a positive atmosphere around budgeting and financial management.

By approaching the situation with empathy, understanding, and a willingness to collaborate, both partners can work towards a more stable financial future while strengthening their relationship.

Join the Discussion

Image credit: Pixabay (This is example image – Not the actual photo)

Image credit: Pixabay (This is example image – Not the actual photo)

What do you think? Would you have handled this differently?

Share your thoughts below! Vote: Do you agree with Reddit’s verdict?